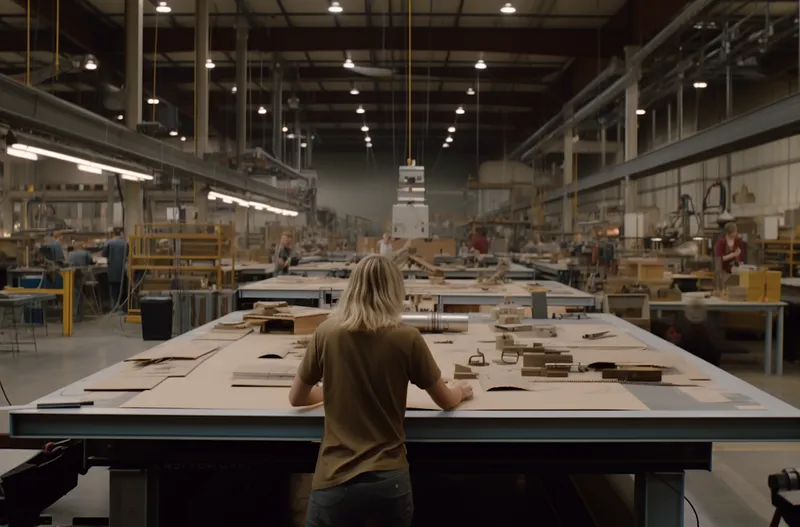

Construction & Development

Specialized accounting for construction companies and real estate developers, managing project costs, progress billing, and construction-specific tax considerations.

Read further

Dedicated accounting services for non-profit organizations, ensuring compliance with regulations while maximizing program funding and donor trust.

- Grant compliance and restricted fund accounting

- Donor restrictions and fund segregation

- Program vs. administrative cost allocation

- Form 990 preparation and IRS compliance

- Board reporting and financial transparency

Non-profit and charitable organizations face unique financial challenges including restricted funding, grant compliance, and regulatory reporting requirements. Our specialized non-profit accounting services help organizations maintain financial transparency, maximize program funding, and ensure compliance with IRS regulations.

Restricted Fund Accounting Grants and donations often come with restrictions that must be tracked separately and reported specifically.

Program vs. Administrative Costs Non-profits must demonstrate efficient use of funds by properly allocating costs between programs and administration.

Regulatory Compliance Form 990 filing, unrelated business income tax, and state registrations require specialized knowledge.

Donor Transparency Maintaining donor trust through accurate financial reporting and proper fund usage tracking.

Fund Accounting & Compliance

IRS Compliance & Reporting

Financial Management

Grant Management

Donor & Fundraising Accounting

Program Accounting

Charitable Organizations

Membership Organizations

Educational Non-Profits

Mission-Driven Focus Non-profits prioritize their mission over financial management, requiring specialized support.

Regulatory Complexity Non-profit regulations are extensive and frequently changing.

Stakeholder Transparency Boards, donors, and regulators require detailed financial transparency.

Fundraising Dependency Success depends on maintaining donor trust through proper financial stewardship.

Ensure your non-profit organization maintains financial integrity and maximizes its impact. Contact us today for specialized non-profit accounting services that support your mission.

We understand the unique financial challenges faced by non-profit & charitable organizations businesses and provide specialized accounting solutions tailored to your industry needs.

- Bookkeeping

- Tax Compliance

- Financial Planning

- Audit Support

Other industries we serve with specialized accounting expertise

Specialized accounting for construction companies and real estate developers, managing project costs, progress billing, and construction-specific tax considerations.

Read further

Comprehensive accounting solutions for medical practices, clinics, and healthcare organizations, ensuring compliance with healthcare regulations while optimizing financial performance.

Read further

Take control of your financial future with Mulberry 's expert accounting services.