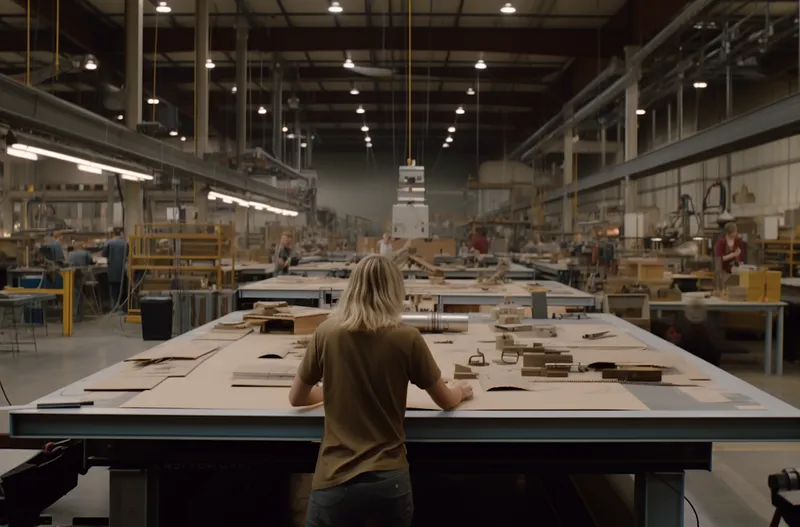

Construction & Development

Specialized accounting for construction companies and real estate developers, managing project costs, progress billing, and construction-specific tax considerations.

Read further

Comprehensive financial services for real estate investors, property managers, and development companies, handling complex property accounting and tax optimization.

- Property-level financial tracking and reporting

- Depreciation schedules and tax optimization

- Tenant billing and lease accounting

- Investment property performance analysis

- Real estate tax compliance and incentives

Real estate investment and property management involve complex financial structures, tax strategies, and regulatory compliance. Our specialized real estate accounting services help investors, property managers, and developers maximize returns while maintaining proper financial records and tax optimization.

Property-Level Accounting Each property requires separate financial tracking, making portfolio management complex and time-consuming.

Tax Optimization Real estate offers unique tax benefits including depreciation, 1031 exchanges, and cost segregation that require specialized knowledge.

Lease Accounting Commercial leases involve complex rent calculations, escalations, and tenant improvement accounting.

Investment Performance Measuring ROI, cash flow analysis, and property performance metrics require sophisticated financial analysis.

Property Financial Management

Tax Planning & Compliance

Lease & Tenant Accounting

Investment Properties

Property Management

Development & Construction

Commercial Real Estate

Residential Real Estate

Asset-Intensive Nature Real estate involves significant capital investments with long-term holding periods.

Complex Tax Rules Real estate tax laws are among the most complex, with frequent changes and opportunities.

Portfolio Management Managing multiple properties requires sophisticated tracking and reporting systems.

Regulatory Environment Real estate faces extensive local, state, and federal regulations.

Don’t let complex real estate accounting undermine your investment returns. Contact us today for specialized real estate accounting services that protect and grow your property portfolio.

We understand the unique financial challenges faced by real estate & property management businesses and provide specialized accounting solutions tailored to your industry needs.

- Financial Planning

- Tax Planning

- Investment Analysis

- Bookkeeping

Other industries we serve with specialized accounting expertise

Specialized accounting for construction companies and real estate developers, managing project costs, progress billing, and construction-specific tax considerations.

Read further

Comprehensive accounting solutions for medical practices, clinics, and healthcare organizations, ensuring compliance with healthcare regulations while optimizing financial performance.

Read further

Take control of your financial future with Mulberry 's expert accounting services.